Listen and subscribe on your favorite podcast service by clicking an icon:

TONY MAREE TORREY

is the host of the

Legacy in the Making Show

She is also LA's Foremost Success Coach hired by Founders, Financial Professionals and High Achievers AROUND THE WORLD

to turn limitations into strengths, increase competitive edge and create a positive and profitable impact.

LEARN MORE ABOUT TONY MAREE HERE

Find out more about the next Innate Wisdom Business Council Mastermind HERE

SHOW NOTES:

EPISODE GUEST:

Every Legacy Maker needs to build a robust business especially if an exit option you are considering is acquisition.

Tricia Salinero is the Managing Partner at Woodside Capital Partners offering world-class strategic and financial advice to emerging growth companies in the technology sectors. In her 20+ years as a Mergers and Acquisitions expert, she has completed more than100 technology mergers and acquisitions valued at $4 billion. She’s represented companies that sold to Google, Microsoft, Red Hat, Oracle, American Greetings and Autodesk just to name a few.

So if you’re at all interested or you know someone who would benefit from knowing how to plan a powerful exit strategy then please listen up and spread the word.

Tricia is also a mission to ensure underrepresented founders have access to economic opportunities that are normally reserved for the old boys club.

There is a lot of capital out there to grow startups in tech and we’re going to talk about how you can get ready to access them.

EPISODE SPONSOR:

The Innate Wisdom Business Council a professional mastermind that empowers purpose-driven, socially conscious leaders to amplify their instincts, transcend limitations and leverage their position to increase profits while creating positive change in the world.

IN THIS EPISODE YOU WILL LEARN:

- The top 5 critical steps to creating a robust and/or acquisition ready business

- The characteristics of a great leader

- The one critical mistake most CEOs make as they grow their business

- Why the “soft skills” are actually profitable and critical to telling your company’s story

- How to apply these critical components to strengthen your business whether you want to sell or not

- Why Tricia thinks it’s a big mistake for CEO’s to hire business consultants instead of a Business Success coach like Tony Maree

Whether you want to sell your business eventually, or not, Tricia’s decades of experience and insider knowledge she shares in this interview are a must listen for anyone who wants to build a successful enterprise.

Hosts & Guests

Tricia Salinero

Managing Partner, Woodside Capital

Mergers and Acquisitions Expert

Tony Maree Torrey

LA’s Foremost Business Success Coach

Share, subscribe and listen to the podcast on your favorite service

Scroll for Interview Transcript

Tricia Salinero 0:00

Oftentimes, startups have a little bit of a transition just mentally handing those tasks off to other people. And to the extent that you don’t do that, you are going to find yourself pulled in 10 different directions and away from the direction you should be focused on which is growth of the business.

Tony Maree Torrey 0:21

Welcome to the legacy in the making Show. I’m your host LAe’s foremost Success Coach Tony Maree Torrey, I interview leaders and influencers who have gone beyond the superficial markers of success and claimed true fulfillment by leveraging their positions to create positive and profitable changes in their businesses and beyond. They share their stories and offer real world boots on the ground experience. That translates into practical advice to apply to your

Unknown Speaker 0:53

own journey. I invite

Tony Maree Torrey 0:55

you to this injection of wisdom and inspiration so you can prevail and leave your own legacy. Legacy makers it’s Tony Maree Torrey here with the legacy in the making show and today I’m so excited to introduce you to Tricia sellin arrow and Tricia is the managing director of Woodside Capital Partners, a world class strategic and financial advice firm for the emerging growth companies in the technology sector. And in her 20 years as a mergers and acquisitions expert, Tricia has completed more than 100 technology mergers and acquisitions valued at 4 billion that’s with a B billion dollars. She’s represented companies that sold to people like Google, Microsoft, Red Hat, Oracle, American Greetings and Autodesk just to name a few. So I’ve invited her here today. So she can share some sage advice with us on how we can prepare our company for acquisition and potentially access funds that will help us grow. So anyone, especially in the technology sector, if it’s not you, if you know someone that’s in the technology sector, this is going to be such a powerful Episode Four helping you prepare and plan powerfully for an exit strategy and also for how you can just set your business up for success in general. So if it’s not you, please spread the word I’m sure you know someone that is a founder that’s trying to grow their business. Tricia also is on a mission to ensure that underrepresented founders have access to economic opportunities that are normally reserved for that old boys club we all know exists. So there’s a lot of capital out there that you can use to grow startups. And we’re going to talk about how you can get ready to access them. So Trisha, I’m so thrilled to have you here. Would love to hear a bit of your backstory, how did you get into the mergers and acquisitions world?

Tricia Salinero 3:20

Thank you, Tony Maree, I really appreciate you having me here today. I it’s a little bit of luck, serendipity, and of course, hard work. That got me into m&a. I had been working through my graduate degree at night. And I needed a technology, you know, job during the day to sort of pay my bills, ended up working for a company first as a temp of all things and then moving into a full time position in corporate development, and learns the some of the early ropes on how do you do licensing deals? How do you work with product managers? How do you work with technologists, and it was an exciting time in the business because the business had just gone public. And they were really trying to kind of grow that business in a in a thoughtful way. As part of their journey, the company’s during a company called supermag. They were actually approached by a buyer and that buyer was a competitor. And as part of that, they said, Okay, we’re going to combine these two companies together. And we’re really just interested in the engineers. So Trisha, you can either stay or take the package. And I said, huh, you’re just interested in the engineers. Okay. I think I’ll take the package.

Tony Maree Torrey 4:51

Right, an early golden handshake. That’s pretty cool. Well, being a temp.

Tricia Salinero 4:56

Yes, exactly. Exactly. So yeah, um, looked around and realized that investment bankers, m&a advisors had been in our doors. And I really wanted to know what they did. And so I reached out to a couple of firms and said, I’m really good at history, I have an undergraduate degree in history of all things, which doesn’t usually translate well to investment banking. And I have a master’s degree in Public Administration, running cities. And that’s not also perfectly placed for investment bankers. But I was good at research. And that was part of what I think has, you know, been the early attraction to technology is that, yeah, there are all these areas of research.

Tony Maree Torrey 5:43

I love that because because my original way back in the day degree is in graphic design. So that’s great.

And then I ended up working

for technology companies, I, I was actually part of a startup that was acquired by a fortune 500 company, I own a global product. And I actually own the company’s only proprietary piece of software. This is way back in the day, right? Just because we’ve got a degree and one thing, life pass, take us in different ways. And I think it’s a lot to do with just we do develop skills, like you develop that research skill, right? Like no experience ever goes to waste is really what it comes down to.

Tricia Salinero 6:29

Absolutely, absolutely. And part of my graduate degree was in organizational development. So I got that opportunity to then use some of those skills, you know, along the way as well. Right. So back to your your idea, no skill, you know, go goes unused. Right,

Tony Maree Torrey 6:44

exactly, exactly. Once in a while the graphic design thing comes in.

Tricia Salinero 6:49

That’s perfect.

And so I, you know, ended up calling a middle market firm called Broadview, and I said, I’m not sure what you guys do there. But here are my skills. And I really would love to talk to you through how that might be relevant. and ended up working for what turned out to be one of the largest independent tech bankers, you know, in the 90s. Grew up there from an analyst to an associate VP, Principal, and then the tech downturn,

Tony Maree Torrey 7:23

I was gonna say, it must have been an exciting time because you went through the whole dot.com bubble, right? Yes,

yes.

Tricia Salinero 7:31

I learned a lot of great skills and up markets, and then not so much, you know, in the down market, right, you know, what do you do. And so in 2001, when the market kind of fell apart, I ended up looking around, I was part of the sixth round of layoffs. At the time, there were no small banks and small deals getting done. And I really thought that if there was a road to recovery, that those deals were the ones that were going to get accomplished over the next couple of years. They wouldn’t be, you know, these massive billion dollar deals, there would be $10 million deals and $20 million deals. And so I put together my own firm called me forth partners, and ran that for the next 10 years. Yeah, it was it was a scary time. Because I you didn’t know what I was doing. I think that’s part of the journey, too, right is questioning, you know, how you’re how you’re getting these things together?

Tony Maree Torrey 8:36

Yeah. So you really do have full on what I call boots on the ground experience of what it’s like to to start and create a powerful startup. And you were very successful with that. Right. And it sounds like, to some extent, you flew by the seat of your pants?

Tricia Salinero 8:55

Yes. As we all do.

Tony Maree Torrey 8:58

What do you think helped you in terms of because I’m very interested in helping my clients access what I call their innate wisdom. And that’s when we really when we make decisions based on our real, true deepest knowing rather than oftentimes we we rely a lot on the head based stuff the logic and and make decisions from fear and scarcity and things like that. What do you think it was that served you to be able to navigate these really very choppy waters and be successful?

Tricia Salinero 9:33

I think it is having that sense of, I’ve listened to all of these other voices. I’ve listened to advisors, I’ve listened to family, every single part of the way you have these people who will chip in their voice. And really there has to be something to your point about the innate resources, what inside of you resonates with that message. You know, now that I’ve seen these three alternatives, And I, I’m a list maker. So sometimes I would do my pluses and minuses. And sometimes, you know, those pluses and minuses really come down to what’s my gut feeling? Right? You know what, really, I don’t have a basis. In fact, I have a list. But what is my gut feeling? Tell me, right. And I’ve learned through not trusting that gut feeling that I need to trust it.

Tony Maree Torrey 10:27

Give us an example of, of when you didn’t trust you, can you conjure up a memory of something that happens when when you didn’t trust what you knew and what the fallout of that was?

Tricia Salinero 10:39

So I had a theory that pre transaction positioning was going to be a path as part of being an m&a advisor. So this idea that you could, you know, 612 18 months in advance of a transaction, start setting yourself up for ways to be more successful. And as part of that process, in my new fourth days, I hired consultants to help guide my clients through some of that process. Sound theory, I sound theory. But what happened is, I made incorrect choices in the types of consultants, what I really should have done was on, you know, partnered with someone like you, and and had my CEOs, you know, talk to someone who could bring forth their own success, instead of the types of consultants that I did work with, which came from large, you know, very expensive firms, who had ideas about companies that weren’t appropriate for startups. And so that mismatch, you know, I was following the playbook. But that that playbook didn’t resonate with my own feelings about how to, you know, actually talk companies through these

Tony Maree Torrey 12:06

times. I love that. And that is, of course, so in alignment with my experience, I work with people from all sorts of industry, from real estate, to financial advising to tech startups, and in between. And what I say, you know, I get to see the results of what, what happens when you actually do the kind of work that I do and get to the point where you really have very well honed instincts, you’re super clear on what your company’s mission is, what your values are all those seems to have all those really important building blocks in place, it is oftentimes less about the theory. And people say to me, you know, like, it’s really interesting to me, you don’t have to be an expert in real estate, you don’t have to be an expert in financial advising in order to help me grow my company. And it’s because really, it’s loads, you know, what we call soft skills, that actually, so often can make the difference. I love that example. That’s interesting that you’ve had very similar experience in your career.

Tricia Salinero 13:13

And those soft skills make a huge difference and add that pre transaction stage. Because part of that that mission, 12 months, 18 months in advance is telling your story in a way that can be known. Right? So being vocal about it going out there. And even if it’s a press release on your own website, and there’s no other distribution, how are you telling your story in a way that is both authentic is available and indexable and understandable for buyers to come and and see what is your company all about?

Tony Maree Torrey 13:50

Yeah, absolutely. That’s all just it’s there’s such important building blocks. And I do think oftentimes what happens when you are forming a startup. And you know, this, and I know this having been part of the startup world is that it is very easy to be pulled in a zillion different directions. And getting that honed in focus and making sure that you are developing the important building blocks of that business. It can be really hard when you’re oftentimes initially as the leader, also a chief cook and bottle washer.

Tricia Salinero 14:25

Exactly, exactly. And I find oftentimes, startups have a little bit of a transition, just mentally handing those tasks off to other people. And to the extent that you don’t do that, you are going to find yourself pulled in 10 different directions and away from the direction you should be focused on which is broken the business

Tony Maree Torrey 14:49

Yeah, right lately. In fact, just recently, I was I was working with a CEO who was still doing payroll

Tricia Salinero 15:02

Yeah, they

Tony Maree Torrey 15:04

have a little bit of a power struggle over that. And then she like she came back to me a week later because we did the work on it. You know what I mean? It’s like we we dissected the thoughts and the beliefs that she had, that were keeping her feeling like she needed to be the one to do that. Right. So once we once we deconstructed all of that, and came up with a new way of looking at things, a few days later, she actually hired someone to do that. And she came back to me and she said, Wow, like, I’m really starting to realize that there’s really a process for creating a leader and there’s definitely a process for creating a great leader.

Tricia Salinero 15:42

Yes, you obviously over and over again.

Tony Maree Torrey 15:45

Right. Right. Exactly. Definitely. Well, you’ve obviously had the opportunity to, to meet and know a lot of great leaders as you’ve gone down this path, because you actually really get to meet people when they’ve reached that point, that acquisition ready point, right? What is some of the characteristics that you recognize in those leaders that the legacy makers in this audience might want to build up as their personal Arsenal?

Tricia Salinero 16:13

I think, you know, some of the most important and successful talents that I see again, and again, are that talent to tell your own story, and very authentically and crisply, so it’s not just authentic, but it’s also in a way that is digestible for people. And I think that often sort of founder owners, founder operators have that a little bit more coaching that needs to be done. But you know, along the way to tell that story crisply, in a way that’s digestible for certain audiences. Yeah, you may have a very different story that you tell your customers versus the people who you might find as investors. And I think telling that story in a sort of monotone. A one one card one vision is not necessarily the best, it doesn’t serve the company in the best way.

Tony Maree Torrey 17:14

Right? Exactly. I totally agree with you there. People learn from stories. And it is one of the things that I that I work with people on, I’m actually pretty gifted as I have clients that are like, I’m super stuck on this. And I, I actually because of the neurofeedback technology and stuff that I that I use visual with myself and my clients when they’re here in person, which of course isn’t happening right now. Because I’m a bit of a geek, I come from the tech world, right? So it’s like I employ anything that’s going to make people more effective. So my typing speed is really laser fast and can tie that to speed that people are talking. And so all they have to do is sit there and kind of blurt it out. And I’ll be like typing it and rephrasing it, but making sure I’m capturing their words as well, at the same time, and that’s one of the funnest sessions I do with my clients is working on the story component.

Tricia Salinero 18:03

Exactly. And, and telling that story in a in a crisp way, is is very vital, if you’re going to go out for outside capital and get investors to get behind you. Yeah, and there are all sorts of different types of capital that might be available. Um, you know, there are angel investors, there are banks, certainly, there are venture capitalists. And then as the company becomes much more profitable, there are companies that segmented as private equity suppliers. And what I’ll tell you about all that is there’s a ton of money out there. And so to the extent that you’re telling your story, in an authentic way, and working your networking skills, you can tell that story again and again and again. And it’s going to take that because honestly, every day that you’re looking for money is an enterprise sales day, you are an enterprise sales person as a founder, right? Yeah. And so having a pipeline of 100 targets. And all of those targets tend to be venture Angel, you know, whoever they are, but you’re going out to them and you’re telling the story again and again. And you’re refining it along the way based on the feedback that you have, and looking at every no as an opportunity to better refine that story. And that’s, that’s one of the things that I think you can do well in advance of a transaction point of financing points that will help the company.

Tony Maree Torrey 19:40

Tell us a bit more about what you can do in advance. I remember the last time we were talking, you shared with me that you had a friend that reached out to you and said, Okay, this is what I want to do and you took a look at his business and went, my friend, you’re not ready, but these are the things you need to do. You gave him like a pretty specific shopping list. Yes, right? Yes, you needed to do to get acquisition ready. And, and the fact of the matter is, is that I know we’re talking about acquisitions today. But these principles still work whether you want your company to be acquired or not, right? Because really what you were doing was you were teaching them how to set up for success. Exactly. So what was the shopping list? Come on, we want to know, the insiders.

Tricia Salinero 20:30

Know, you know, a couple of the things along the way, I have a top 10 tenants that I will share with companies, you know, oftentimes, and, and it’s going through and making sure that you have clean financials, that you have worked with professionals along the way, who have some expertise and giving you an employment agreement or an invention and assignment agreement. And I know the tendency, because I’ve done it myself as a startup person is to find the easiest, cheapest available for free on the internet version of these things. But you do need to remember that there is there’s a time and a place for that. So the things that worked for you, at your corporation, and the attorney that you found around the corner from the local gas station is probably not the same person that you’re going to want when you’re delivering 5 million in sales or 10 million in sales. And that letting the maturity of your advisors mirror the maturity of your company is a very important sort of tenant. Beyond all of this, you want an attorney that has experience in financings or experience in large OEM deals, or whatever that that crash will timeframe might be. So that’s sort of one one area is get your back office in order hire a payroll specialist. And make sure that that is is following that maturity and that you’re not always looking for sort of the cheapest opportunity. I think the next thing again, harkening back to be available to be known. Talk to talk to industry magazines, talk on Twitter to yourself, even, you know, put things on your web on your website. But these days, especially these days, people are doing research from their desk. And so they’re trying to find you and you you need to be available to be found. That’s probably the next biggest area that we find, you know, people have some level of I won’t call it immaturity, but it caught it, it comes behind their maturity of the company, it doesn’t all mature at the same time. And

Tony Maree Torrey 22:48

it sounds like really, you’ve got to get your social media strategies, your marketing campaigns and get your story, your company’s story and your story as the founder as well. Because invariably, like people buy from people that they like, you’ve got to be what Russell Brunson calls the the likable personality. So having those pieces of the equation out there consistently publicly making sure that you’ve got an execution plan and strategy in place, and then the resources to deploy it. That sounds like so that’s your number two. So number one is get your back office in order. And number two is get your marketing your visibility and your promotion components in. Okay. And then

Tricia Salinero 23:37

the next biggest area is really about understanding your landscape. And so understanding both Who are your competitors, and who are potential partners going forward. And having those conversations along the way, I will tell you over the hundred deals that I’ve done, you know, 75% of the time, the buyer knew of the seller. So there had been some awareness created, whether they worked together on a transaction, maybe the seller stole a deal from the buyer, you know, they they are integrated in in software or hardware within the company in the customer. All of those things are a great premise for an acquisition, or even a strategic financing. So sometimes these large companies will make investments in smaller companies to see them grow into a good partner. And so looking for those touch points, and those those ecosystem builders can be very important along the way.

Tony Maree Torrey 24:42

I love that ecosystem builders look for the ecosystem builders and build relationships with them. Really essentially what I’m hearing you describe is relationship. And I’m assuming when you say like stole a deal, it was not necessarily doing something down and dirty, but more or less But more like we had, we had a competitive thing going on with a prospect. And that person that company one that deal, Aaron square, yeah.

Tricia Salinero 25:15

parentsquare products right. And so to the extent that small company has a better product, one of the things that large companies look at is how do I do outsourced r&d, research and development? How do I build things that are small, nimble teams that can extend my product can extend my market. And those things often happen in startups. And so think of mergers and acquisitions, really as outsourced research and development there. You want to be that extensible team, to that large company?

Tony Maree Torrey 25:57

Yes, exactly what happened in my history, that was exactly why we had the acquisition of our startup and the product that I was responsible for was the reason why we were required.

Tricia Salinero 26:10

Yes. Mm hmm. And and I’ll tell you, there is a long tail of acquirers. So that’s, that’s sort of the other thing is, oftentimes companies come to me and they say, Well, I know Google is a perfect acquisition partner for me. And I’ll say, okay, that’s great. But let’s talk about who’s beyond Google, right? Because if you look at the last five years of acquisitions, there were about 7000 acquisitions in technology over that period of time, and regardless of what number you buy into some numbers are a lot higher than that in terms of acquisitions and technology. And only about 6% of those were done by the top 20 companies. And so you look at Google and Amazon, and Apple, and GE, and all of these companies that do several acquisitions, still a very, very small number of the overall acquisitions in tech, which means that the bulk of deals are really done by one, one company will say, I’m going to do one acquisition this year, I’m going to do one acquisition in three years, that one z two z acquisition strategy. And so I tell companies look for that long tail, look for companies that are in your segments who are maybe 10 times bigger than you, instead of 1000 times bigger than you. And those might be really good partnership.

Tony Maree Torrey 27:43

That’s awesome. This is such amazing information. So if I have collected all the brilliant gems that you’ve given us so far, it comes down to where we’re getting the story, right, the story of the founder, and the story of the company, and the mission, and all those important components, mission values, all those important components in place in a succinct way. So they can be communicated and adapted, depending on your audience. And then we were getting our back office in order, and perhaps looking at where the back office was when we first started and where it needs to be when we’re acquisition ready. Yes. And then we need to work on our outreach, our marketing, our visibility, all those pieces and make sure that those are well in place. So people know, I mean, and it’s not like that isn’t obvious, like everyone knows they need to market their company, right. But we’re talking about this marketing, from a slightly different perspective, this is marketing towards the acquisition opportunity. The next thing was making sure that we don’t just assume that we need to go for a big fish like Google, that there is a much bigger pool of people that whether they want to acquire your business or whether they want to invest in your business, there’s a much bigger pool, and that there were 7000 transactions at a minimum, depending on whose numbers you account for. That happened and only 6% of those were with the with the big ticket companies. So definitely a way to like expand your mindset and your awareness and bring in opportunity for yourself. That’s amazing. What else do we need to know? Well, I think

Tricia Salinero 29:24

one of the things that that comes up, I often in my conversations with founders is well what do I do if I am approached? You know, what are the types of approach strategies? What counts as an approach? And and what should I do with those things? And so I’ve found that founders will often get these inbound calls, and they’ll they’ll get a voicemail or an email that they didn’t expect, and that might be from someone in corporate development at a company. It might be from an analyst or an associate at a private equity firm. firm, it might be from, you know, someone who just says, hey, let’s take this relationship to the next level, in terms of someone that you may be already working with. And what I found, as part of that is to think through both who is making that approach? And where they sit in the organization? And is that someone who can make a decision or think about you’re the target? And what that looks like, you know, is that person capable of writing a check? Probably not. Really, what they’re doing is, is doing that groundwork? How do I know more about you? How do I know how big you are? What have I been able to glean about you out there in the world. And so I think it’s important to understand the origination of that, to understand whether or not you want to develop that relationship. And to know that not all inbounds require action, that’s yet another piece of of the story. Because once you’ve been approached in this way, and you’ve delivered a certain amount of information, it’s time to have a conversation with someone who can write a check who has profit and loss, p&l responsibility for bringing you into the company. And getting that champion within a buyer is very important.

Tony Maree Torrey 31:27

What would you say is the best approach for someone to build relationship with that champion?

Tricia Salinero 31:34

I think that it comes really, the best approach of all things is that you share a customer, if there is a way to talk about we share this customer, that that drives so many more conversations down the line, and I think can be really vital to say, okay, you know, one of my top 10 customers also uses your product now, and I wanted to talk to you about maybe ways that we could further either market together or tell the same story or integrate in some better way to make it easier for customer. That is the most compelling story that you can tell.

Tony Maree Torrey 32:11

I love that. And that is such powerful language right there. So I hope that you guys are taking this taking notes on this, because Wow, the gems that Trisha is sharing with us are amazing. We and Tricia sadly where we’re running low on time. And so we won’t be able to get to all 10 of your tips for the aspiring exit strategy for the for the founder and the CEO that wants to be able to either be acquisition ready, or just to make sure that their company is super strong and successful because the same principles really apply. But how can people get a hold of you? What is that? What’s the best way that they can maybe get the rest of your 10 tips and tools? Sure,

Tricia Salinero 32:59

come to our web website, which is Woodside cap.com. And I’m Tricia at Woodside cap calm. So you know either send me an email, hit the website, we have a lot of free industry reports that go into specific sector research on these reports. And I’m happy to send them the 10 tips as well.

Tony Maree Torrey 33:20

That’s perfect. Thank you so much, Tricia, this has been a great conversation. I hope you found it very informative. As a legacy maker, I will make sure that we have all this information for you on the show notes on the website legacy in the making show. And also feel free to listen to us on iTunes. were aiming for the new and noteworthy list. So hit that subscribe button, where almost all the way there I’m very excited. We’ve had a lot of great response and hopefully you will help us get there and be a part of this legacy in the making. With that, Tricia, it’s been such a pleasure. I’m really looking forward to potentially interviewing again, maybe we can have a conversation about the next five tips.

Tricia Salinero 34:04

Thank you so much for joining me. I really appreciate it. It was great meeting with you.

Tony Maree Torrey 34:09

I’m glad you tuned in to the legacy in the making show. If you’re genuinely interested in creating positive change in your business or your life or on a more global scale, I invite you to connect with me at Tonymaree.com that’s Tony with a why Maree with two E’s. When you get there you’ll find the path to purpose master plan, the truly brilliant method to make sure you’re clear on why you’re here. This is the absolute critical foundation to honing your instincts and leaving a legacy you’ll be proud of. You can also find out about the innate wisdom Business Council which has an opportunity to evolve your vision in the company of like minded leaders and much much more. Thanks for listening. Remember to subscribe to the podcast and we’ll see you next time.

Recent Episodes

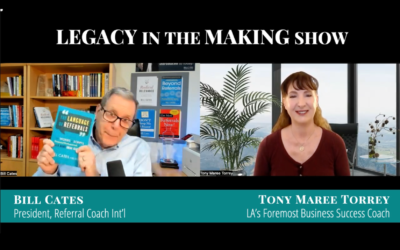

021: The Language of Referrals Exactly How to Explode Your Business – Bill Cates

Discover the secrets to building a successful business through powerful referrals and master the art of client acquisitionListen and subscribe on your favorite podcast service by clicking an icon:TONY MAREE TORREY is the host of the Legacy...

020: How to find your Heaven on Earth and make a difference in the world- Martin Rutte

Learn how to make a positive contribution to the world and and become a powerful heaven-maker.Listen and subscribe on your favorite podcast service by clicking an icon:TONY MAREE TORREY is the host of the Legacy in the Making Show She is...